Fiche de préparation - Presser une éponge

De WikiMontessori

- Explorer le monde

Presser une éponge

Attendus

|

Utiliser, fabriquer, manipuler des objets |

EM15 |

Choisir, utiliser et savoir désigner des outils et des matériaux adaptés à une situation, à des actions techniques spécifiques (plier, couper, coller, assembler, actionner...). |

Pré-requis

Aucun

Séquence

Une seule présentation

Variables de différenciation

- Une observation préalable de l'enfant a permis à l'enseignant de proposer ce travail correspondant le plus précisément possible à ce moment donné aux besoins et aux possibilités de l'enfant.

- Ce travail s'inscrit dans une progression allant du plus simple au plus complexe et du plus concret au plus abstrait.

- L'enfant reprendra cette activité librement à son rythme.

- De nombreux autres outils dans la classe lui seront proposés pour travailler les mêmes objectifs.

Objectifs spécifiques

- Transvaser à l'aide d'une éponge

- Développer la motricité fine

- Développer les fonctions exécutives

Rôle de l'élève

- Répète le nom des objets et des actions

- Observe attentivement les gestes de l'enseignant pour les reproduire

- Attend son tour pour réaliser l'activité de manière autonome, après la présentation par l'enseignant

Rôle de l'adulte

- Nomme les objets et les actions

- Montre les gestes

- Guide l'élève dans ses gestes

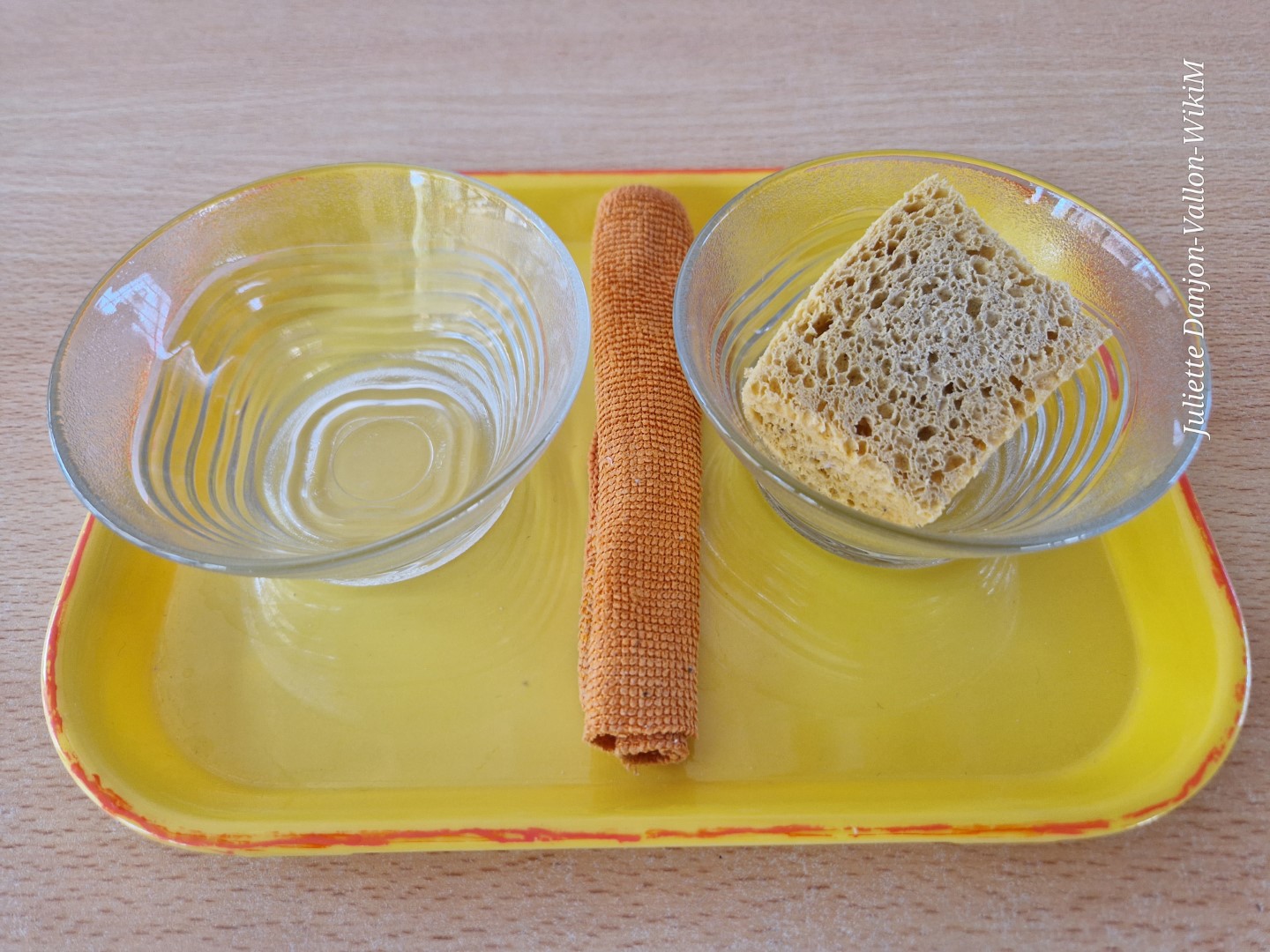

Matériel

- Un plateau avec deux bols identiques blancs

- Une éponge naturelle toujours humide

- Un seau d'eau (rouge), une petite serviette éponge (rouge)

Préparation

Aujourd'hui, nous allons presser une éponge !

- Aller avec l'enfant vers l'étagère

On va avoir besoin de ce plateau et de ce seau rouge.

- Montrer comment porter un plateau

- Demander à l'enfant de porter le plateau sur une table

- S'asseoir avec l'enfant assis à gauche

- Demander à l'enfant s'il connaît les objets du plateau, lui présenter le matériel

Il nous faut encore quelque chose

- Aller chercher un seau avec lui, le poser entre les deux chaises

- Porter le seau le long du corps, 2 mains pour relever l'anse

- Verser le seau à 2 mains, la main supérieure tenant l'anse

- Expliquer qu'on va avoir besoin d'eau

- Sortir l'éponge et la poser sur le plateau

On va remplir ce bol d'eau !

- Demander à l'enfant de prendre le bol de droite à deux mains

- L'enfant porte le bol jusqu'au robinet

- L'adulte ouvre l'eau et remplit le bol posé dans le lavabo

- Retourner s'asseoir avec l'enfant

Activité

- Tremper l'éponge dans le bol de droite

- Observer l'éponge qui se gorge d'eau

- Échanger des regards complices

- Saisir l'éponge, attendre qu'elle ne goutte plus

- La placer au-dessus de l'autre bol et l'essorer

- Faire le mouvement de pince : doigts serrés qui se referment sur le pouce

- Répéter l'action jusqu'à ce qu'il n'y ait plus d'eau dans le bol de droite

- Faire l'inverse, du bol de gauche vers le bol de droite

Rangement

- Mettre l'éponge sur le plateau

- S'essuyer les mains avec la serviette

- Se lever pour vider le bol rempli d'eau dans le seau

- Aller au lavabo vider l'eau du seau

- Inviter l'enfant à retourner chercher de l'eau pour qu'il puisse faire l'activité à son tour

- Accompagner l'enfant au lavabo

- Quand l'enfant a fini l'activité, lui rappeler de ramener son plateau sur l'étagère

- L'inviter à refaire l'activité aussi souvent qu'il le souhaite

Expression - Métacognition

- Expliciter le but de connaissance du travail « je vais t'apprendre à transvaser à l'aide d'une éponge »

- L'enfant doit comprendre au travers du matériel autocorrectif s'il a réussi ou pas.

- Encourager du regard et par quelques mots sur les tentatives échouées pour amener à la répétition volontaire de l'activité

- Exprimer sa confiance dans l'élève, mais ne jamais faire de feedback immédiat de leur activité, même positif

Remarques

- Avant de ranger le plateau, vérifier s'il est nécessaire de mettre une serviette propre et bien éponger table et plateau

- Aller chercher l'eau est un mouvement global

- Presser l'éponge relève de la motricité fine

Activités langagières

Vocabulaire : éponge, eau, plateau, bol, presser, transvaser